So if your financial statements are prepared based on IFRS, then you should use Statement of Financial Position instead of Balance Sheet. Obviously, internal management also uses the financial position statement to track and improve operations over time. Evaluating the financial position of a listed company is similar, except investors need to take another step and consider that financial position in relation to market value.

Components of a Balance Sheet

Detail of it could be found in the statement of change in equity and Noted to Financial Statements. Shareholders’ Equity, Owner’s Equity, or Stockholders’ Equity are called differently in the Balance Sheet because of the nature of the business. Inventories are the main items in the Balance Sheet of a manufacturing company. In the Balance Sheet, Assets are reported in the first part before Equity and Liabilities.

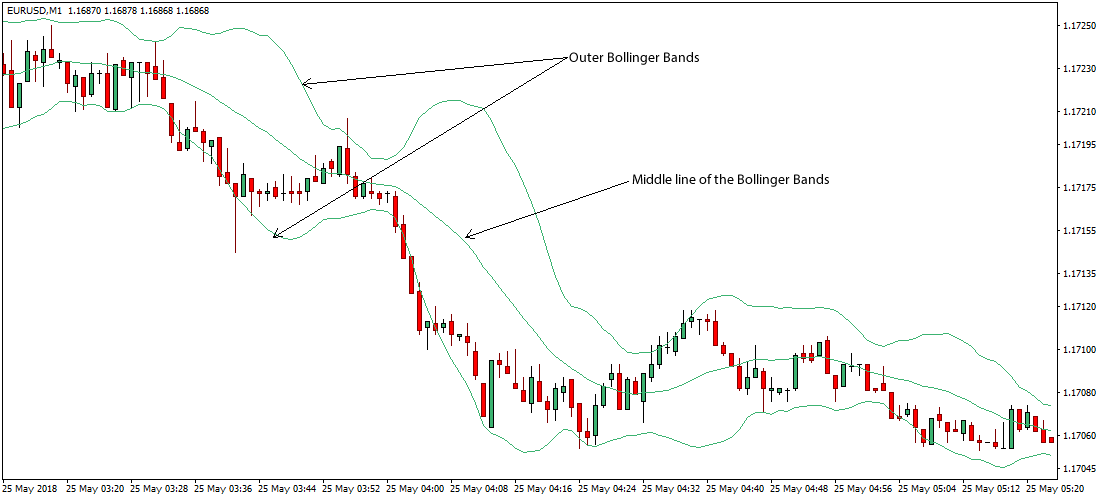

This definition is true in the sense that this statement is a historical report. This is in contrast with other financial reports like the income statement that presents company activities over a period of time. The statement of financial position only records the company account information on the last day of an accounting period. The current ratio—which is total current assets divided by total current liabilities—is commonly used by analysts to assess the ability of a company to meet its short-term obligations. An acceptable current ratio varies across industries, but should not be so low that it suggests impending insolvency, or so high that it indicates an unnecessary build-up in cash, receivables, or inventory. Like any form of ratio analysis, the evaluation of a company’s current ratio should take place in relation to the past.

Statement of Functional Expenses

One of the most important sources of reliable and audited financial data is the annual report, which contains the firm’s financial statements. A company can use its balance sheet to craft internal decisions, though the information presented is usually not as helpful as an income statement. A company may look at its balance sheet to measure risk, make sure it has enough cash on hand, and evaluate how it wants to raise more capital (through debt or equity). Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health.

- Financial strength ratios, such as the working capital and debt-to-equity ratios, provide information on how well the company can meet its obligations and how the obligations are leveraged.

- Extensive academic evidence shows that companies with low market-to-book stocks perform better than those with high multiples.

- Financial position is the current balances of the recorded assets, liabilities, and equity accounts of an organization.

- Financial statements are reports compiled by businesses that detail the company’s financial activities and health.

- Report the balance of cash and cash equivalence that is to the entity at the reporting date.

Business Insights

The remaining amount is distributed to shareholders in the form of dividends. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Users of statements of financial position include management personnel, business owners, employees, lenders, and other stakeholders. While cash flow refers to the cash that’s flowing into and out of a company, profit refers to what remains after all of a company’s expenses have been deducted from its revenues. An ability to understand the financial health of a company is one of the most irs form w vital skills for aspiring investors, entrepreneurs, and managers to develop. Armed with this knowledge, investors can better identify promising opportunities while avoiding undue risk, and professionals of all levels can make more strategic business decisions.

Do you own a business?

The statement of financial position includes a company’s assets, liabilities, and equity. It may also include information about a company’s cash flow, earnings, and performance. The statement of financial position, also known as the balance sheet, is a what is an executive summary financial statement that shows a company’s assets, liabilities, and equity at a specific point in time. The balance sheet can be used to give insights into a company’s financial strength and health.

It reports a company’s assets, liabilities, and equity at a single moment in time. You can think of it like a snapshot of what the business looked like on that day in time. Beyond the editorial, an annual report summarizes financial data and includes a company’s income statement, balance sheet, and cash flow statement. It also provides industry insights, management’s discussion and analysis (MD&A), accounting policies, and additional investor information. The statement of financial position, often called the balance sheet, is a financial statement that reports the assets, liabilities, and equity of a company on a given date.

Liquidity and solvency ratios show how well a company can pay off its debts and obligations with existing assets. Financial strength ratios, such as the working capital and debt-to-equity ratios, provide information on how well the company can meet its obligations and how the obligations are leveraged. These ratios can give investors an idea of how financially stable the company is and how the company finances itself.

The CFS allows investors to understand how a company’s operations are running, where its money is coming from, and how money is being spent. The CFS also provides insight as to whether a company is on a solid financial footing. Operating revenue is the revenue earned by selling a company’s products or services. The operating revenue for an auto manufacturer would be realized through the production and sale of autos. Operating revenue is generated from the core business activities in a bank reconciliation what happens to the outstanding checks of a company. Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt.