This includes the cost of materials, labor, equipment, and any overhead expenses. CIP accounting, or Construction-in-Progress accounting, is an essential aspect of accounting for businesses in the construction industry. It involves the management of financial transactions related to the construction of long-term assets, such as buildings and infrastructure. In the following article, learn everything you need about CIP Accounting with Viindoo Enterprise Management Software. Construction accounting is not just tracking accounts payable, receivable, and payroll. Unlike other businesses, construction companies have to manage other anomalies like job costing, retention, progress billings, change orders, and customer deposits.

- CIP is not depreciated until the asset is placed into service upon completion, at which point it is reclassified to the appropriate fixed asset account.

- In the world of finance and accounting, numerous acronyms are used to describe various concepts and processes.

- CIP accounts are established to track and monitor the initial costs incurred during this stage.

- 5G and IoT – Connected devices and equipment provide continuous streams of granular operational data to optimize workflows, resources, and expenses.

- When costs are incurred during the construction or development phase of a project, they are initially recorded as CIP on the balance sheet.

Controller Services: Operational Financial Management

Involves feasibility studies, architectural plans, surveying, zoning permits, and finalizing project specifications before construction begins. – Managing CIP accounts require proper knowledge, experience, and advanced bookkeeping tools. That’s another reason why it is better to delegate CIP accounts to the experts who know how to help you avoid such mistakes and stay compliant. Company ABC would now start to depreciate the equipment since the project finished. Our primary service is that of a Fractional CFO with the supporting services of a Bookkeeper and Accountant.

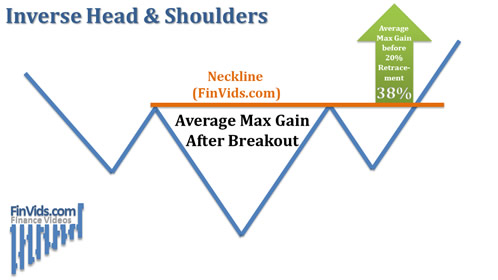

- Revenue recognition hits peak while last expenses booked—retentions released post handover.

- These two phrases might be used interchangeably, or they might mean something else entirely to two different businesses.

- By accurately monitoring and managing costs, construction companies can achieve better cost control, improve project management, and make informed financial decisions.

- This includes expenses that occur after construction is completed, but the asset isn’t put in service yet.

- In addition to potentially wreaking havoc on your finances, these problems can also be a major red flag for sureties and lenders.

- In construction accounting, the percentage of completion (POC) method is widely used to recognize revenue throughout the project’s duration.

Financial Literacy Matters: Here’s How to Boost Yours

Regular meetings and updates are essential to keep all stakeholders informed about project progress, potential issues, and resource needs. This collaborative approach helps in identifying and addressing problems early, thereby reducing the risk of delays and cost overruns. Best practice involves creating new subtasks and cost codes to track change order expenses separately from original budget items. Cash Flows – Flawed CIP cost projections can impact operational and financing decisions by presenting an inaccurate picture of future cash flow requirements. Such detailed records enable construction firms to closely track cash outflows, analyze expense trends, improve decision-making, and enhance audit readiness. Such measures minimize errors, safeguard assets, ensure the https://www.bookstime.com/ accuracy of financial data, and facilitate auditing processes.

Related Questions For Tax Accountant

Depending on the project’s size, construction work-in-progress accounts can be some of the largest fixed asset accounts in a business’s books. The appropriation of revenues and expenses should be made in the relevant accounting period according to the work’s percentage completion. It also dictates which revenues and costs related to a https://www.instagram.com/bookstime_inc construction contract should be recorded and when to record. Rather than construction in progress, you might see construction in process on financial statements. These two phrases might be used interchangeably, or they might mean something else entirely to two different businesses.

- Once the construction work is completed, the costs accumulated in the CIP accounts are transferred to fixed asset accounts.

- However, as the company expands, recruits more employees, and works simultaneously on multiple projects, tracking transactions on a spreadsheet gets difficult and time-consuming.

- It reflects partly completed products that are still in the production process.

- Digital Twins – Virtual models of construction sites updated in real-time facilitate remote monitoring, simulations, and predictive analytics regarding costs and scheduling.

- However, you must know that the nature of costs and revenues in every construction contract varies.

- Keeping accurate and up-to-date construction-in-progress accounts is also important because they tend to be the target of auditors.

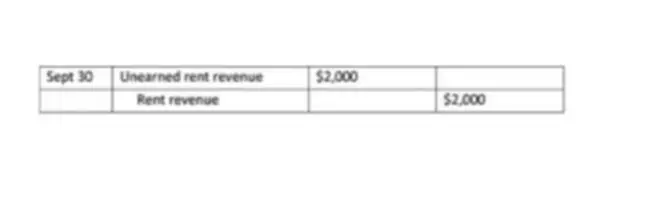

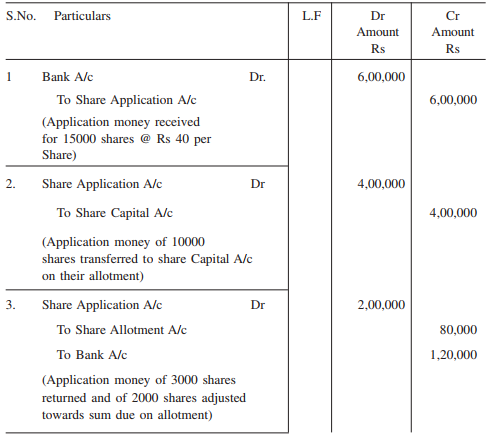

What is the accounting entry for construction in progress?

- Overbilling can result in strained client relationships, disputes, or even legal issues.

- By capitalizing these costs, companies can more accurately calculate and support their tax deductions, ensuring compliance with applicable tax laws.

- Construction-in-Progress (CIP) accounting is indispensable for businesses striving to maintain accurate and comprehensive financial records.

- The very nature of construction projects spans over longer time horizons and involves significant upfront investments before revenue generation can begin.

- Direct costs include materials, labor, and subcontractor fees, which can be directly attributed to the project.

- Compensate contractors for actual costs incurred plus predetermined profit margin percentage.

- As a result, the construction-work-in-progress account is an asset account that does not depreciate.

Overbilling and underbilling are common challenges in construction accounting that can negatively affect project finances. Overbilling refers to charging more than the actual work completed, while underbilling occurs when the amount billed is less than the work performed. In the design and planning stage, construction professionals create detailed construction plans and blueprints for a new building. CIP accounts continue to accumulate costs related to design and planning activities, including architectural and engineering fees. Keeping accurate and up-to-date construction-in-progress accounts is also important because they tend to be the target of auditors.

This creates unique challenges for financial planning, cost control, performance reporting, and informed decision-making. After the construction has been completed, the relevant building, plant, or equipment account is debited with the same amount cip meaning accounting as construction in progress. After the completion of construction, the company will record depreciation on the asset. A construction company might come to your mind by reading the phrase “Construction In Progress.” Indeed, construction in progress accounting is mostly used by construction firms. Besides business dealing in building huge fixed assets, also use construction in progress accounting.