For the reason that it requires going back to the brand new blog post-trade running, clearing, and you can settlement of the change. Much of it has to do with old options nonetheless inside destination to reconcile asset control and you can percentage anywhere between exchanges, cleaning organizations, and you can brokerages. In an age of instant communication and you will live monetary analysis, traders still need to waiting weeks when planning on taking ownership of your stocks it purchase or even discovered percentage to your brings they promote. Undertaking on may 28, 2024, All of us deals usually “settle” (finish the exchange out of bucks for stock) in a day unlike a couple of.

- Post-trade running plays a role in that it confirms the main points from a deal.

- Regarding trade large amounts away from cryptocurrencies, it can truly be somewhat complicated.

- There are a number of reasons why a protection was traded OTC unlike for the a transfer, for instance the size of the company as well as the nation where they is based.

- The new sections offer no sign of the fresh investment merits of the business and should not end up being construed as the an advice.

- If you were to pick five-hundred BTC from a company dining table, you’d very first fund a free account together and then give a range you are willing to order it to have.

Thread analysis, if the considering, is alternative party views on the total bond’s credit worthiness at the the time the new get is assigned. Analysis are not information to purchase, hold, otherwise sell securities, plus they do not target the market property value ties otherwise their viability to possess funding intentions. Spending features inside treasury membership giving 6 month United states Treasury Bills to the Personal program are as a result of Jiko Bonds, Inc. (“JSI”), an authorized agent-agent and you may member of FINRA & SIPC. JSI uses money from the Treasury Membership to find T-bills inside increments from 100 “par value” (the brand new T-bill’s value from the maturity). The value of T-costs vary and you can investors could possibly get found almost than simply its brand-new opportunities in the event the sold just before maturity. T-bills is subject to price alter and you may accessibility – yield is subject to change.

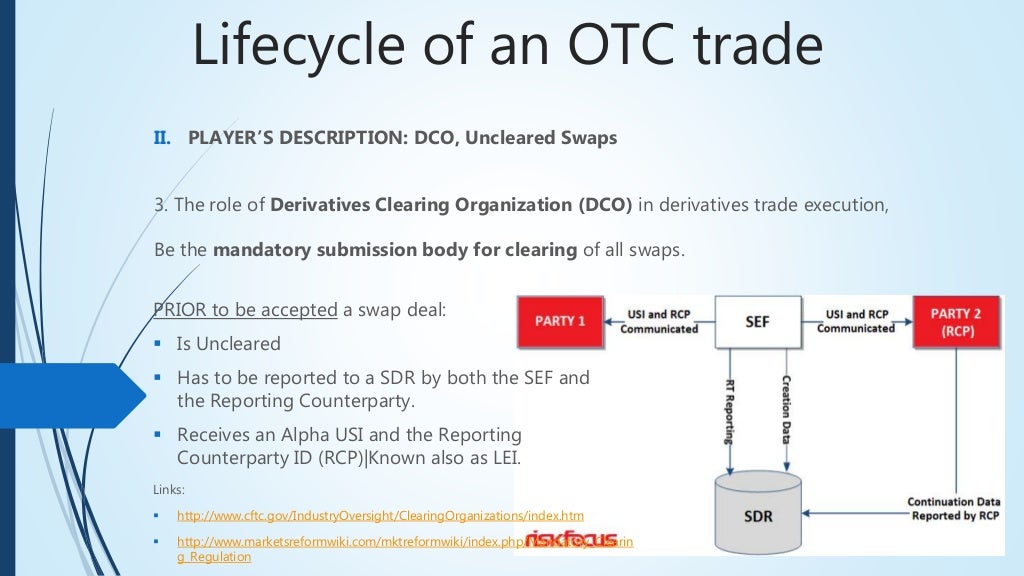

It lead to an increasing number of buyers withdrawing using their market-and then make services, exacerbating the new liquidity condition and you can causing a major international credit crunch. One of many regulating initiatives done in the wake of your own crisis to resolve this problem is actually using clearinghouses to own blog post-trade processing out of OTC trades. Constantly, an investor contains the OTC protection, then it would go to a broker-dealer, and then the broker-broker positions it on the person that has to shop for they. The security’s price isn’t indexed publicly because it will be on the an exchange controlled by the Securities and Exchange Fee, says Brianne Soscia, a good CFP away from Riches Contacting Group located in Las vegas.

Much more positions are carried out during the high frequency because of the machines simply. (2) Clients don’t sell the fresh bonds purchased up to full commission from compensated fund has been made. Inventory payment violations may appear whenever the fresh trades are not securely covered by settled fund. Here we talk about the main kind of payment abuses as well as how to quit him or her. OTC Locations Class operates probably the most better-identified networks, such as the OTCQX Best Business, the brand new OTCQB Venture Market, and the Pink Open market. Whether or not OTC sites are not authoritative exchanges like the NYSE, they have qualifications standards influenced by the new SEC.

If not cautiously looking over maps he can be found considered his next journey otherwise playing around a 5-a-front side football community. A primary advantage of on the web exchanges is an amount of privacy and you may quick change. Carrying to a couple of thousand bucks within the dollars to restore to have crypto is probably not the brand new wisest suggestion. Fool around with some traditional experience if you intend to help you trade in physical merchandise and you will/or currency. Your first vent away from phone call would be to screen exchange nourishes discover a sense of exactly how costs are trade. You can then pick up some crypto inexpensive to your a move otherwise among the actions mentioned previously.

Although not, brokers and you can market makers doing OTC alternative segments are usually controlled from the specific regulators agency, including FINRA regarding the You.S. Concurrently, even if margin criteria inside margin accounts are determined to your a good trade-date foundation and you will aren’t switching, the brand new percentage period to own Control T (initial) margin calls has started quicker by the 1 day so you can T+3. Thus the change inside payment go out doesn’t replace the cycles linked to fulfilling repair margin calls, as these are set in accordance with the day the phone call took place. Currently, if you purchase a protection such an inventory otherwise bond, the complete-service or online brokerage need to receive payment away from you no afterwards than simply a couple of business days after the trading try performed.

Choice Property purchased to the Social program are not kept inside the a general public Spending brokerage account and therefore are mind-custodied by the consumer. The newest issuers ones securities can be an affiliate marketer away from Societal Using, and you may Public Spending (otherwise an affiliate) get earn charge after you buy or sell Alternative Possessions. To learn more about dangers and you may disputes interesting, come across these disclosures. Zero render to shop for securities is going to be acknowledged, with no area of the price is going to be received, up until an offering declaration recorded for the SEC might have been licensed by the SEC. A sign of desire to shop for bonds concerns no obligation otherwise union of any kind. OTC change is short for more-the-stop trade, and is a phrase accustomed define the entire process of exchange monetary assets in person between a few functions without the need to experience a main exchange.

Mainly, since the selling or buying huge amounts of crypto is hard. Such as, If you decided to make an effort to pick five hundred BTC you’d run into a host of issues. Basically, OTC places try in which the most trading within the worldwide financial system happens.

If you’re also an inferior investor, the new NextHash OTC crypto program is also a great provider for you. It will help you prevent checklist your crypto property for the traditional exchanges and you may paying considerable amounts of cash on the listing costs. If or not you’lso are trade huge amounts from crypto or just will not want going right on through antique change locations, NextHash is the proper system to you! If you’d in addition to for example far more methods to subjects such exactly what is OTC trade in the crypto, definitely find out more to your all of our web log point. OTC segments and you will replace segments are a couple of ways of organizing monetary locations.

In the March 2017, the newest SEC reduced the fresh settlement several months away from T+step three so you can T+two days in order to echo advancements inside technical, enhanced trading volumes and you will changes in money services the brand new trade surroundings. Schwab is required to restriction clients’ ability to extend commission past the newest change day to possess 90 schedule weeks whatever the case where both of these requirements aren’t fulfilled (freeriding). When an inventory change is carried out in the a money membership, the funds doesn’t accept a couple full trading days. Limiting very short-term positions to help you paid fund can assist slow down the danger of violating settlement laws and regulations. If you buy a safety that’s not marginable following settled finance are essential to possess complete percentage. Therefore, funds admission can happen inside a great margin membership for many who purchase and then promote a non-marginable defense before paid financing has protected the purchase.

Over-the-prevent (OTC) mobula trade comes to trade securities outside a primary exchange. OTC exchange usually happen because of an agent-dealer community, as opposed to in one, consolidated change including the NYSE or Nasdaq. Arbitrage involves to find/promoting a product or service in a single venue then attempting to sell/to find it back to various other location at the a far greater rate so you can safer a return.

Mobula: What’s crypto OTC?

Over-the-avoid trading will be a useful means to fix purchase foreign organizations with us bucks, and other securities one to aren’t on the biggest transfers. After you change more than-the-prevent, in addition there are usage of huge businesses such Tencent, Nintendo, Volkswagen, Nestle, and Softbank one to aren’t listed on biggest U.S. transfers. But OTC trading really does feature a few dangers, as well as lower regulating oversight than market change change and better volatility. OTC holds reduce liquidity than simply its exchange-exchanged peers, reduced trading regularity, big spreads between your quote rate plus the query rate, and you can little in public areas readily available advice. It contributes to him or her getting volatile opportunities which might be constantly speculative in general. Concurrently, due to the nature of your OTC locations and also the services of your companies that trading OTC, investors would be to carry out comprehensive research prior to investing in these firms.

A funds liquidation citation is when your promote a protection and you can utilize the proceeds to pay for acquisition of another security you bought on the an earlier change time. OTC Red Open-market, earlier known as red sheets, is the riskiest number of OTC exchange no conditions in order to report financials or join the new Ties and you will Change Percentage. Some genuine businesses exist on the Pink Open market, yet not, there are many layer organizations and you may companies without genuine organization surgery these. The brand new OTCQX doesn’t list the new holds you to definitely sell for shorter than just five bucks, known as cent carries, cover enterprises, or enterprises dealing with bankruptcy proceeding. The fresh OTCQX comes with merely 4percent of all of the OTC carries replaced and requirements the brand new higher reporting requirements and strictest supervision by the SEC.

OTC bonds are an array of monetary devices and merchandise. Economic tools replaced more than-the-avoid is holds, loans ties, and you will types. Carries that are replaced over-the-restrict constantly fall into quick firms that do not have the tips to be listed on formal exchanges.

Replace areas, including the Nyc Stock exchange and/or NASDAQ, act as mediators anywhere between consumers and providers and you may support the brand new change of monetary assets between the two. All of this happens in the fresh discover on the cost out of additional financial possessions noticeable on the loyal websites and all the brand new deals in public exhibited. Rather, they add several networks managed by brokers and you may investors through the internet.

What is actually an over-the-stop business?

Ethereum provides quick-tracked cryptocurrency creation possesses hence never been more straightforward to do what is amusingly referred to as “shitcoin”. Modern-date regulations have a tendency to favor the new rich (people and you can businesses) as the precisely the wealthy can afford to checklist to your certain transfers. And, sometimes, only investors with a high web worth (so-named “accredited”) are allowed to buy other companies/programs. Cryptocurrency is actually a great grassroots direction built to peak the fresh playing field. Contrast which that have exchanges and therefore listing the new change price and you will make you a be for what just be investing in their cryptocurrency.

In metropolitan areas such Venezuela and you can Zimbabwe buying and selling cryptocurrency more-the-restrict are/was used to save small economies heading considering the Bodies destroying its discount with hyperinflated report currency. For the majority of, the phrase can establish images from effortless access to therapy. OTC, however, has existed for a long time and you can brings the sources from a few of the basic shop-centered change of goods. They refers more especially to your easy access part than just something else.

Over-the-stop (OTC) 's the trade away from ties ranging from a couple counterparties performed outside of authoritative transfers and without the supervision from an exchange regulator. OTC trading is performed within the over-the-restrict places (a decentralized lay with no actual location), because of dealer sites. Post-trading services has recently arrived at the newest vanguard as a way to own however this is to help you diversify the cash streams. For those trying to cash-out some of the payouts (or what’s kept out of a loss), find out if the representative also offers transfers on the bank membership by using the Automated Clearing Home (ACH) otherwise by using a cable tv transfer. If you fail to do something about notification, community legislation need you to definitely Schwab sometimes demand an extension, or purchase right back or offer from the status, along with draw your account with a freeriding citation.

An enthusiastic OTC market is a good decentralized industry in which people and you can agents can be trade carries, offers, currencies, or any other monetary tool myself ranging from both and you may as opposed to a intermediary. That’s where more change purchases within the economic field happen. Foreign exchange, or Fx, is among the most well-known OTC business while the currencies commonly traded to your antique transfers however, because of a system away from banking institutions. Over-the-avoid, otherwise OTC, areas are decentralized economic areas where a couple functions change economic tools playing with an agent-agent. Certainly possessions exchanged regarding the more-the-restrict industry is unlisted stocks.

In comparison to a primary dining table, agency tables don’t exchange with the own finance meaning that, do not assume industry exposure. As opposed to a spread founded design, department desks charge you to act because the a good middleman so you can representative a great deal for a counterparty. For individuals who tried to buy it all of the on one replace, chances are you to no-one body’s promoting 500 BTC in the any given day — you would need to purchase it from multiple providers.

Eventually, since there is no secondary field, the only method to intimate an enthusiastic OTC options position is always to create an enthusiastic offsetting exchange. An offsetting exchange often effectively nullify the effects of your own unique change. This can be inside stark contrast to an exchange-listed solution where manager of that alternative simply must return to the fresh exchange to market its status. In america, over-the-restrict change from stocks is performed due to systems away from industry suppliers. The two better-known networks try addressed from the OTC Places Category plus the Monetary Community Regulation Expert (FINRA).

To buy a protection on the OTC market, select this protection to purchase plus the amount to dedicate. OTCQX is amongst the prominent and most well-known marketplaces to have OTC holds. All the agents one promote replace-detailed ties in addition to offer OTC securities which can be done electronically to your a broker’s program otherwise thru a phone. Ties, ADRs, and you will types trade in the newest OTC marketplaces, yet not, investors deal with greater risk when investing a lot more speculative OTC ties. The brand new filing standards between list systems are different and you may team financials can get end up being tough to to find.

Dominating comes from the definition of, “dominant chance.” When you change with a principal table, they normally use their particular money to shop for any resource you are to buy, and in case risk along the way. Over-the-restrict (OTC) trade desks such as System Change gamble an essential character from the crypto industry but few individuals understand this it’re also important, the way they functions, and you may just what distinguishes you to of some other. As part of our very own purpose to give you key field understanding, we from the Community Search make an in-breadth go through the relevance, framework and you will taxonomy away from crypto trading tables. OTC Areas Class, an authorized, has created about three sections according to the high quality and you may level of in public places offered advice. Such sections are created to offer traders expertise to the count of data one to companies provide. Securities can be move from one tier to the another in accordance with the regularity out of economic disclosures.

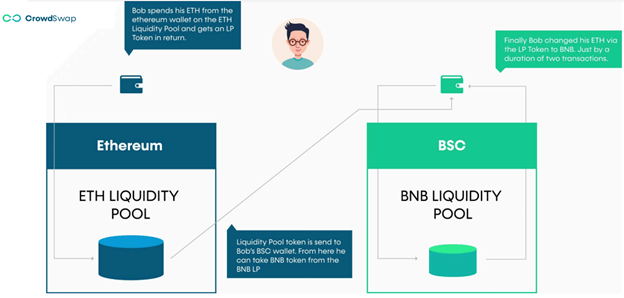

To fully get rid of the middleman, its group provides followed fascinating cryptocurrency tech called atomic swaps. Trading can be done through MetaMask otherwise right from the very safe Ledger Nano S otherwise Trezor resources bag. Consider recent condition for the OTC equities highest price dissemination list and more. Inserted agencies is also meet Continuing Degree requirements, view the world CRD listing and you will do almost every other conformity employment.

You guess full responsibility for exchange decisions you make centered on industry analysis offered, and Social isn’t liable for one losings caused myself or ultimately by your usage of including information. Industry info is provided entirely to possess informational and/or informative aim just. This isn’t implied because the a recommendation and will not show a good solicitation otherwise an offer to purchase otherwise sell one form of security. There are certain reason why a security will be replaced OTC instead of to your a transfer, such as the sized the organization and the nation in which they is based.

Since the ICOs shot to popularity in the 2017, significant finance have been getting increased in the Ether and you can venture creators widely used OTC desks to transform Ether to the fiat to help you pay day-to-go out expenses. Miners — individuals which receives a commission inside the recently minted crypto to run machines one to safer sites such as bitcoin — explore OTC desks to convert crypto into their regional fiat currencies so you can shell out expenses. Furthermore, a move you to definitely collects charge within the crypto have a tendency to change OTC in order to convert back into fiat or increasingly, to the stablecoins such as USDC. In addition to the trading location, OTC choices range from noted possibilities because they are the end result from an exclusive transaction between your consumer plus the vendor. Which cleaning home action basically towns the newest exchange as the middleman. Industry along with establishes particular terms for strike cost, such all the five things, and termination times, such as for the a certain day’s per month.

Liquidity identifies exactly how without difficulty you can get otherwise promote your cryptocurrency. Bitcoin is one of water cryptocurrency international as the away from high demand and therefore a high frequency away from exchange. Check out the business capitalization away from Bitcoin to your all of our crypto tracker. Clearly, the main city flows for the Bitcoin provides much outpaced any cryptocurrency. There’s nothing finishing you from selling and buying cryptocurrency individually to your neighbors. The majority of people do not understand otherwise have fun with crypto such as this because it’s perhaps not instantly expected.

Derivatives try contracts whoever well worth are linked with a main advantage. The root asset could be many techniques from merchandise to securities to help you rates of interest. Bonds, and bonds bundled to your ETFs, aren’t constantly replaced on the centralized transfers. Instead, most are exchanged OTC on the supplementary market through agent-buyers. Now that you’ve got a far greater comprehension of just what OTC change mode, let’s look closer at the what is actually OTC trading within the crypto.

Crypto OTC change simply form exchange cryptocurrency on the decentralized locations – so, individually between your investor and the representative and you will as opposed to a mediator. Ryan is a web site designer, author, and you can cryptocurrency buyer just who originates from bright Southern area Africa. With personal expertise in the foreign exchange & crypto field trading he or she is constantly looking to comprehend the large monetary picture.

OTC segments are generally smaller clear much less controlled than old-fashioned stock transfers, leading them to riskier to purchase. To date, the consumer and also the merchant contrast trading facts, agree the order, change facts out of ownership, and you may plan for the new transfer from securities and cash. Post-change control is particularly important in segments that are not standard, like the more-the-stop (OTC) areas. You can always update your exit details when the pillow are no more necessary.

A swap will likely be crypto-to-crypto (trading Bitcoin with Ether such) or fiat-to-crypto (swapping Us bucks to possess Bitcoin and you will the other way around). There are 2 basic ways of tossing financial segments — change and you may “over the counter”, or OTC. With OTC possibilities, both hedgers and you will investors prevent the constraints placed on noted possibilities by the its particular exchanges. So it independency lets people to attain their wanted status much more precisely and value-effectively. Alternative assets, and OTCs, is actually high-risk that will not suitable for the investors.

Usually, this occurs about nonetheless it’s not unusual to possess smart arbitrage buyers to take considerable amounts of money abroad to help you make the most of this type of variations. The main takeaway away from their experience is actually that rich create perhaps not play with transfers to buy their Bitcoin. Since these dolphins trade in such vast amounts, the fresh orders do overwhelm transfers and you may disperse the cost dramatically. Consequently, the amount from exchanges doesn’t depict the actual likewise have and you may need for Bitcoin. Back to our five-hundred BTC example, you’d start with requesting a bid thanks to a speak app.

The order confirmation monitor usually notify you if an inventory is not marginable. If you aren’t confident that you might agree to carrying an excellent non-marginable defense for around about three trading days, consider restricting you buy to help you settled finance simply. Inside an OTC business, people act as market-manufacturers because of the quoting rates of which they’re going to trade a safety, money, or any other financial products. A swap can be executed anywhere between a couple of participants inside an OTC industry instead of other people knowing the price where the brand new exchange is actually accomplished. In general, OTC areas are generally shorter clear than exchanges and therefore are at the mercy of a lot fewer laws and regulations. Or maybe the business is also’t afford or does not want to spend the new checklist charge out of biggest exchanges.

This article is for general suggestions aim only, and should not be used alternatively to have visit with professional advisers. The newest OTCQB is often known as „strategy field” having an attention of fabricating businesses that have to declaration their financials on the SEC and you can yield to specific supervision. Yarilet Perez is a skilled multimedia author and you will reality-checker that have a master out of Technology inside the Journalism. She’s got did inside the multiple towns covering cracking information, politics, degree, and more. This may determine and that points we comment and you may come up with (and where those items show up on the site), but it in no way impacts the information otherwise advice, which are rooted within the thousands of hours out of look.

Your bank account can certainly be put on a great 90-time paid-bucks limitation, otherwise happen more serious punishment, along with account closure otherwise removal of digital accessibility. Once more, Schwab subscribers is demand a one-time exclusion (i.age., just after on the lifetime of the newest account) to remove the fresh limit. While it’s widely used inside the antique economic places, OTC change in the crypto still renders of many questions unanswered. On this page, we are going to determine in simple terms what exactly is OTC exchange within the crypto and just how it functions. You acquired’t provides a hard time buying or selling Bitcoin however in the present day ICO increase, you are going to likely has points change altcoins having lower exchangeability.

All of the investments occurs in the brand new unlock and the costs one additional assets trading for are what you find scrolling across the base away from CNBC otherwise for the a website such CoinMarketCap. Traders check out OTC possibilities if the detailed choices don’t a little meet their demands. There is no standardization from hit cost and termination dates, thus professionals basically define her terminology as there are zero supplementary industry. Just as in most other OTC segments, these alternatives interact individually anywhere between buyer and you can vendor.

„Bonds” should reference corporate financial obligation bonds and you will You.S. authorities securities considering for the Social platform because of a personal-led brokerage membership held during the Public Using and you will custodied at the Apex Clearing. For purposes of so it area, Ties exclude treasury bonds kept within the treasury membership having Jiko Ties, Inc. since the explained under the “ Treasury Profile” part. The value of Bonds fluctuate and you will any investments marketed just before readiness can result in get otherwise loss of dominating. In general, when interest levels go up, Bond costs usually miss, and you may the other way around. Bonds with high productivity otherwise supplied by issuers which have straight down borrowing from the bank reviews fundamentally bring a high standard of exposure. All the fixed income ties are at the mercy of price alter and you may access, and you may yield is actually subject to transform.